Polyurethane Condom Industry Research Report (Global & China)

Polyurethane Condom Industry Research Report (Global & China) — Financial Year 2024 Update

Overview

This report provides a comprehensive analysis of the global and Chinese polyurethane condom markets, focusing on production capacity, output, sales volume, revenue, pricing, and future development trends. It includes data from 2020 to the first half of 2025, with forecasts through 2031, aiming to assist industry players and decision-makers with accurate market insights.

1. Market Status and Trends

Global Market:

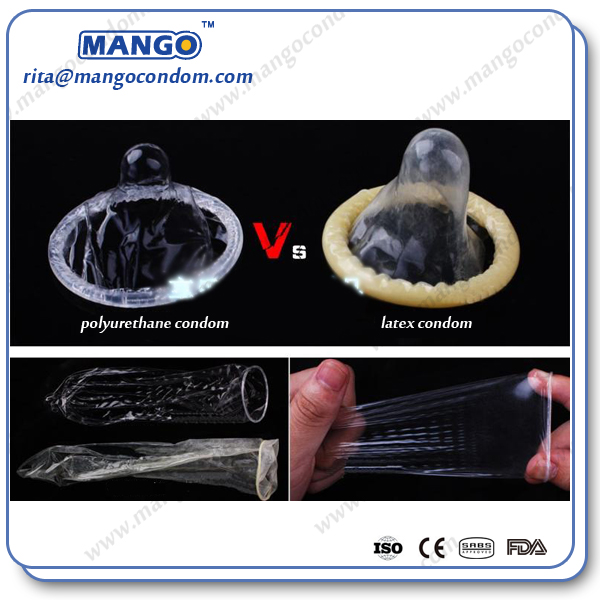

The global polyurethane condom market has experienced moderate growth due to increasing awareness of STI prevention, rising demand for non-latex options, and growing interest in ultra-thin, hypoallergenic products. Polyurethane condoms are particularly favored for their strength, clarity, and suitability for latex-allergic users. North America, Europe, and parts of Asia-Pacific lead in consumption.

China Market:

China’s polyurethane condom segment is in an early growth phase but is rapidly evolving. Although latex condoms dominate, demand for premium and allergy-free alternatives is rising, driven by changing consumer preferences and greater emphasis on quality. Government policies promoting reproductive health and safe sex further support market expansion.

Future Trends:

- Increased R&D in polyurethane formulations for enhanced comfort and sensitivity

- Rising safety in the condom material and formulation, and also in the dipping technology to make it more safe in use for consumers.

- Growth in private label and OEM/ODM offerings

- Integration of smart packaging and sustainability in product design

2. Production and Sales Data (2020–2025)

- Capacity: Global capacity has steadily increased, with China investing in production lines for high-end condoms, more thin and soft feel.

- Output & Sales Volume: Volume is expected to grow at a CAGR of ~7% globally, and ~10% in China from 2023 to 2031.

- Revenue & Pricing: Premium pricing positions polyurethane condoms as high-margin products. Prices are stable with slight increases driven by raw material costs and innovation.

3. Key Players and Competitive Landscape

- Church and Dwight: Known for the TROJAN brand, focusing on innovation and diverse product lines, including polyurethane varieties.

- Ansell: Offers premium condoms like SKYN, expanding non-latex options through branding and global distribution.

- Reckitt Benckiser: Through Durex, continues to invest in ultra-thin and polyurethane technologies, including marketing in Asia.

- Sagami Rubber Industries: Pioneered polyurethane condom development; continues to lead in thinness and quality, especially in Japan and China.

- Okamoto Industries: Competes closely with Sagami, renowned for advanced material engineering and product softness.

- Shandong Ming Yuan Latex Co., Ltd: One of China’s domestic leaders entering the polyurethane condom’s production, their advantage in the polyurethane material’s source study, with growing OEM capacity and focus on export and international markets.

4. Industry Chain & Market Structure

- Industrial Chain: Includes raw materials (polyurethane resins), manufacturing equipment, processing, packaging, and distribution.

- Production Mode: Mainly batch production with strict temperature and sterilization control.

- Sales Mode: Retail (offline/online), medical channels, and OEM/ODM partnerships.

- Policies: Global and Chinese policies support the promotion of barrier contraceptives, particularly those catering to allergy concerns.

- Entry Barriers: High R&D cost, material procurement challenges, regulatory approvals, and consumer trust.

- Favorable Factors: Rising awareness, urbanization, supportive policies, and demand for premium sexual wellness products.

- Challenges: Competition from latex condoms, high production cost, and consumer education gaps.

Conclusion

The polyurethane condom market, while niche, is positioned for sustained growth. With rising health awareness and a shift toward customized, high-quality contraceptive products, global and Chinese condom manufacturers are intensifying R&D and expanding capacities. Companies like Sagami, Okamoto, and emerging players such as Shandong Ming Yuan Latex are expected to shape the future landscape. This market offers lucrative opportunities for innovation, especially in OEM and private-label projects.

As the market matures, strategic investments and regulatory alignment will be critical for brands seeking to lead in the polyurethane condom space.